Compliance Guide - Restore Online Shoppers’ Confidence Act

The federal Restore Online Shoppers’ Confidence Act (ROSCA) protects U.S. consumers from deceptive online billing practices, including aspects of automatic renewals.

For online subscription-based businesses, compliance with ROSCA means following certain requirements. These include providing clear disclosures, obtaining explicit consent and providing easy cancellation processes. Read on to learn what this means for your business.

Update: October 16, 2024 - The FTC’s new “click to cancel” rule supersedes ROSCA.

Disclaimer: The guidance provided herein is for informational and educational purposes only and does not constitute legal advice. Please consult a legal/compliance representative when implementing subscription compliance policies and practices.

ROSCA at a glance

The Restore Online Shoppers’ Confidence Act became law in 2010. The law tasks the FTC with protecting online consumers from being charged without their explicit consent. It’s a nationwide analogue to many state-level statutes, such as California’s automatic renewal law.

Most significantly, ROSCA makes requirements of businesses that provide automatically renewing subscription-based billing and free trials, referred to as “negative option marketing” in the law. ROSCA doesn’t ban subscriptions or trials, as there are many legitimate use cases for them; however, it does put limitations on these practices.

Automatically renewing subscriptions and free trials fall into the category of “negative option marketing,” which is defined in the FTC’s Telemarketing Sales Rule as “a provision under which the customer's silence or failure to take an affirmative action to reject goods or services or to cancel the agreement is interpreted by the seller as an acceptance of the offer.” (16 CFR § 310.2)

We go into greater detail below, but here’s a summary. Under ROSCA, it is unlawful to bill a consumer on an automatic renewal via the Internet unless you:

Provide “clear and conspicuous” disclosures of renewal terms before obtaining billing information, including price, billing frequency and how to cancel.

Obtain “express informed consent” for recurring charges.

Provide a simple, straightforward cancellation mechanism. Cancellation must be “at least as easy” as signup.

The law also prohibits an obsolete but then-common practice called “data pass,” which is of little relevance today.

Before ROSCA made it illegal, the practice of “data pass” was common on the web. Data pass involved the transfer of consumer payment data (e.g. credit/debit card info) to third parties behind the scenes. How it worked: while completing an initial purchase, consumers were presented with additional third-party offers. These often appeared as if they were part of the initial transaction, rather than a new agreement with a new seller. And because the consumer’s billing information was sent to the third party via so-called “data pass” (behind the scenes), consumers were often unaware that they were being billed. ROSCA took aim at this deceptive practice.

ROSCA and subscription signup

The federal law mandates that businesses, when enrolling consumers in subscription billing online, follow guidelines to ensure consumers are adequately informed of all terms before purchase and are not enrolled without their explicit consent.

Disclosures

ROSCA requires that a business provide text that “clearly and conspicuously discloses all material terms of the transaction before obtaining the consumer’s billing information.”

In 2021 the FTC issued an enforcement policy that provides guidance on its interpretation of this clause.

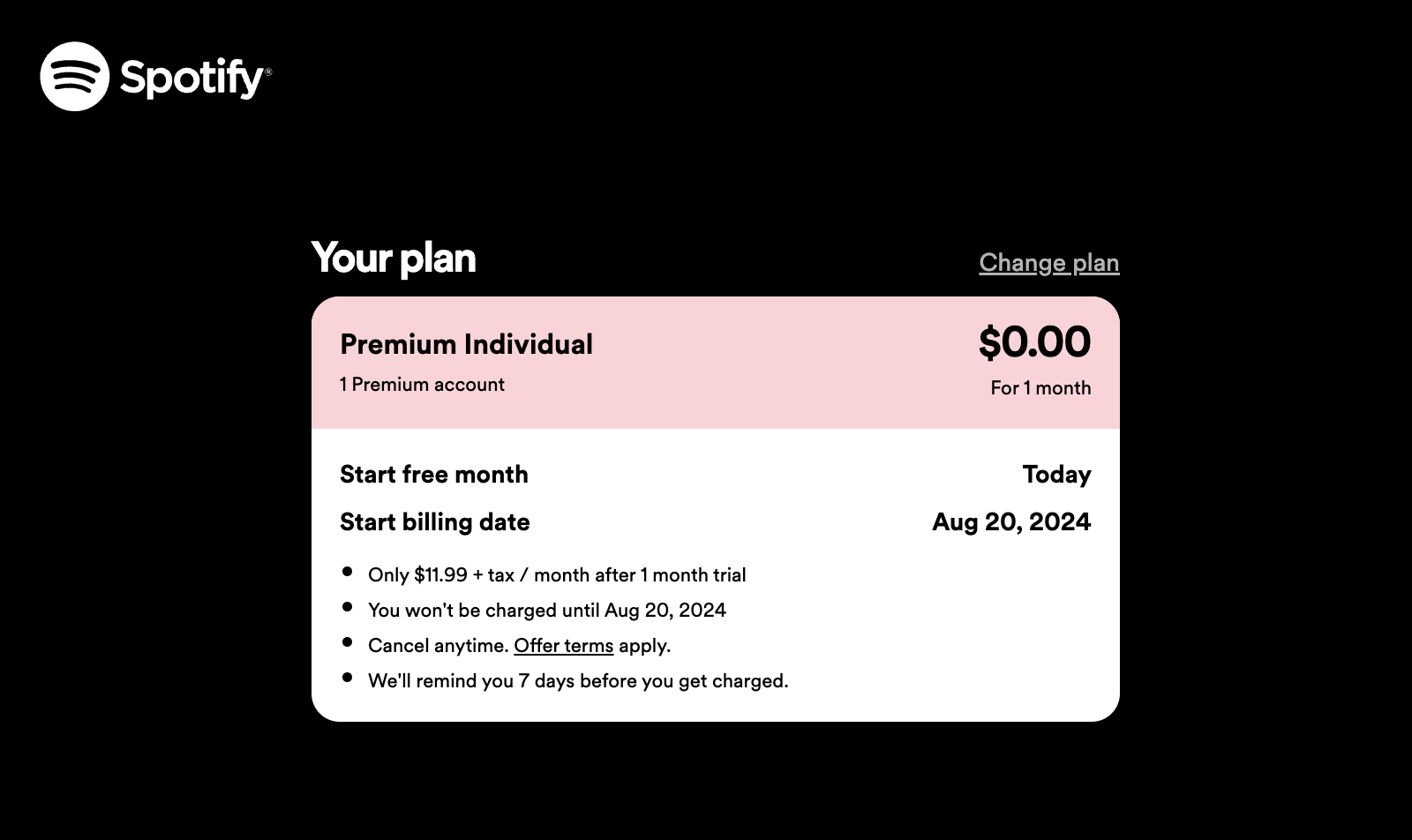

At minimum, terms should include:

That the customer will be charged unless they take action to cancel

The amount that will be billed and the frequency of recurring charges

The date by which they must cancel to avoid being billed

The date the charge will be submitted for payment

All information necessary to cancel

Additionally, you must disclose “[a]ny material terms related to the underlying product or service that are necessary to prevent deception, regardless of whether that term directly relates to the terms of the negative option offer.” The policy states that, according to long-standing precedent, “any express claim or deliberately implied claim is presumed to be material.”

The 2021 policy also clarifies the meaning of “clear and conspicuous.” Disclosures should stand out from accompanying text or other visual elements so that they are easily noticed, readable and understandable by the average consumer. When presented online, disclosures must be “unavoidable.” In other words, they must be visible without requiring the consumer to take action, such as clicking a link or hovering over an icon.

Subscription regulations are constantly in flux. Subscribe to stay up-to-date on the latest compliance developments, churn-prevention strategies and more.

Consent

ROSCA requires that a business obtain “express informed consent” to automatic renewal agreements before charging the consumer.

Again, the FTC’s 2021 enforcement policy provides clarification. Businesses must:

Obtain consent of the subscription separate from other terms

Not include information that “interferes with, detracts from, contradicts or otherwise undermines” the consumer’s ability to provide consent

Obtain unambiguously affirmative consent to automatic renewals and the entire transaction

Be able to verify the consumer’s consent

ROSCA and subscription cancellation

A key requirement of ROSCA is easy cancellation of subscription billing. Once again we look to the FTC’s 2021 enforcement policy for clarity. What does it mean to provide a simple and reasonable cancellation mechanism?

For starters, cancellation should be at least as easy as signup. When canceling, consumers should not be met with offers and deflections that impose “unreasonable delays” to cancellation.

Web-based cancellation flows often require customers to complete multiple steps before finalizing cancellation. The policy makes it clear that attempting to “save” a customer with a special offer (e.g. a discount or free trial extension) is acceptable under the law, but making multiple requests to review additional offers may amount to an unreasonable delay, and thus would be prohibited.

Additionally, the law requires that cancellation be available in the same medium (e.g. website or mobile app) the consumer used to sign up. This clarification at the national level, combined with similar state-based rules, effectively ends call-to-cancel policies.

Online businesses may provide phone-based cancellation in addition to the above. When doing so, the policy states, businesses should answer all calls made during normal business hours. All calls should be answered within a “short time frame” and must not be lengthier or more burdensome than calls used to sign up.

Enforcement

The Federal Trade Commission (FTC) is tasked with enforcing ROSCA. Violations of the act are treated as violations of the FTC rules regarding “unfair and deceptive” business practices.

Businesses that fail to comply with ROSCA may face legal and financial risks, including actions by the FTC and potential lawsuits from consumers or attorneys general of states.

According to a Washington Post article from 2021, the FTC has had “mixed success” enforcing the law. In 2010, the government won a $10 million suit against the makers of ABCmouse (a children’s education product) for unfairly billing users and making cancellation difficult, but the FTC’s high-profile 2015 case against DirecTV was ultimately dismissed when a “federal judge rejected most of the agency’s arguments.”

Since the 2021 enforcement policy, the FTC has filed suits against tech giants Adobe and Amazon for alleged violations of ROSCA.

Conclusion

The passing of ROSCA in 2010 and many state analogues since, plus the more recent ramping up of the FTC’s enforcement, signal increasing attention on subscription “dark patterns” and hardball cancellation tactics. All this makes it important for online subscription-based businesses to ensure compliance or risk legal action and lost consumer trust.

The good news: simple, consumer-friendly cancellation practices are not only great for users, but great for business. Ready to see what’s possible? With ProsperStack Retain you can have a compliant online cancellation flow up and running in days, not months. Start collecting actionable insight while reducing churn 10-39%, all while adhering to federal and state guidelines. Schedule a demo today.