Get Ready for the FTC’s “Click to Cancel” Negative Option Rule

The FTC’s updated “click to cancel” negative option rule comes into effect in 2025. Is your subscription business ready?

On July 8, 2025, the 8th U.S. Circuit Court of Appeals struck down the FTC’s "click to cancel" rule, just days before its major provisions went into effect. While this development removes immediate pressure to overhaul cancellation processes, businesses must still comply with existing state automatic renewal laws and federal guidelines. The FTC may reintroduce a similar rule in the future, so staying vigilant and prioritizing user-friendly cancellation processes remains crucial.

Finalized in October 2024, the Federal Trade Commission's negative option rule, nicknamed “click to cancel,” requires that businesses make canceling a subscription as easy as it is to sign up, and allow cancellation in the “same medium” used to sign up.

It also requires sellers to clearly and conspicuously disclose subscription and/or free trial terms and obtain express informed consent from consumers before collecting payment information.

1. Too often, businesses make people jump through endless hoops just to cancel a subscription.

— Lina Khan (@linakhanFTC) October 16, 2024

Today @FTC finalized a rule requiring that businesses make it as easy to cancel a subscription as it is to sign up for one. https://t.co/kAQM7OChHe

The rule applies to almost all media, including internet, telephone, print and in-person transactions like gym memberships.

This post offers guidance to B2C and B2B subscription-based businesses in SaaS, digital media and ecommerce to help you comply with these new updates to the negative option rule, with emphasis on signup and cancellation.

Disclaimer: The guidance provided herein is for informational and educational purposes only and does not constitute legal advice. Please consult a legal/compliance representative when implementing subscription compliance policies and practices.

End compliance confusion. Get one-on-one guidance from our cancellation experts. It’s free.

Negative option rule at a glance

The FTC’s final rule—retitled the Rule Concerning Recurring Subscriptions and Other Negative Option Programs (RIN 3084-AB60)—aims to update, consolidate and clarify the existing patchwork of consumer-protection regulations that oversee subscription billing, including Section 5 of the FTC Act, the Telemarketing Sales Rule and the Restore Online Shoppers’ Confidence Act.

The FTC rule is a nationwide analogue to many state level statutes, such as California’s click to cancel law. Today more than half of states have some kind of automatic renewal law (ARL) in place. While there are significant similarities across state ARLs, there are also unique and sometimes inconsistent requirements, which can be a challenge for businesses to sort out.

Thankfully, the FTC’s updated rule provides greater uniformity, thus simplifying compliance for businesses. However, it is important to note that state laws still apply to consumers in those states.

In a negative option agreement, a business automatically charges the consumer unless they take action to cancel. This includes memberships, subscriptions and free trials.

To get technical, the rule defines a negative option feature as “a provision of a contract under which the consumer’s silence or failure to take affirmative action to reject a good or service or to cancel the agreement is interpreted by the negative option seller as acceptance or continuing acceptance of the offer, including, but not limited to: (1) an automatic renewal; (2) a continuity plan; (3) a free-to-pay conversion or fee-to-pay conversion; or (4) a pre-notification negative option plan.”

Background

The FTC’s negative option rule goes back to 1979, when it was introduced to limit Columbia Record Club-style “prenotification plans,” in which businesses mailed products to customers if they neglected to decline them.

The rule was expanded in 1992 and 2006 to cover additional types of automatic renewals (e.g. magazine and software subscriptions) and free trials. In 2010, with the passage of the Restore Online Shoppers Confidence Act (ROSCA), the FTC was tasked with protecting online consumers from being charged without their explicit consent.

Much like the final rule, these regulations required clear disclosures, informed consent and easy cancellation; however, their lack of clarity and specificity created confusion for businesses and consumer advocates. In 2019, therefore, the FTC kicked off a multi-year process of updating the rule, beginning with the publication of an “advance notice of proposed rulemaking” (ANPR) to solicit public feedback.

An enforcement policy followed in 2021, and in March 2023, the FTC released its updated “click to cancel” proposal with the aim of providing a consistent legal framework for automatic renewals and cancellations. After evaluating more than 16,000 comments from individuals, consumer groups and trade trade associations, the FTC voted to adopt the final rule with certain changes, as discussed later.

Scope

The 2024 negative option rule provides consistency across media. Requirements apply to all subscriptions, free trials, etc in all media, including internet, mobile application, text/SMS, email, telephone, print and in-person.

Businesses that were previously excluded from similar requirements, like those outlined in the FTC’s 2021 enforcement policy, are subject to the final rule. Additionally, in-person signups are now addressed: for customers who signed up in-person, business must allow cancellation online or via phone.

Yes. The FTC maintains that the regulations cover B2B transactions, stating in the rule: “It has been the Commission’s longstanding view that Section 5 of the FTC Act 172F 173 protects business consumers as well as individual consumers.”

Key provisions

The click to cancel rule’s provisions are similar to those in effect since 2021. In summary, the regulation requires:

Disclosures - Businesses must provide important disclosures prior to obtaining consumers’ billing information.

Consent - Businesses must obtain consumers’ unambiguous and affirmative consent to the subscription.

Easy cancellation - Businesses must provide consumers with simple cancellation mechanisms that immediately stop all recurring charges.

Additionally, businesses are prohibited from misrepresenting any “material fact” while offering subscriptions, free trials or other “negative option features.”

Subscription signup

Let’s take a closer look at how these regulations affect subscription-based businesses, starting with subscription signup and consent.

The federal negative option rule mandates that sellers, when enrolling consumers in subscription billing (in any media, including online, via telephone or in person) follow guidelines to ensure consumers are adequately informed of all terms before purchase and are not enrolled without their explicit consent.

Disclosures

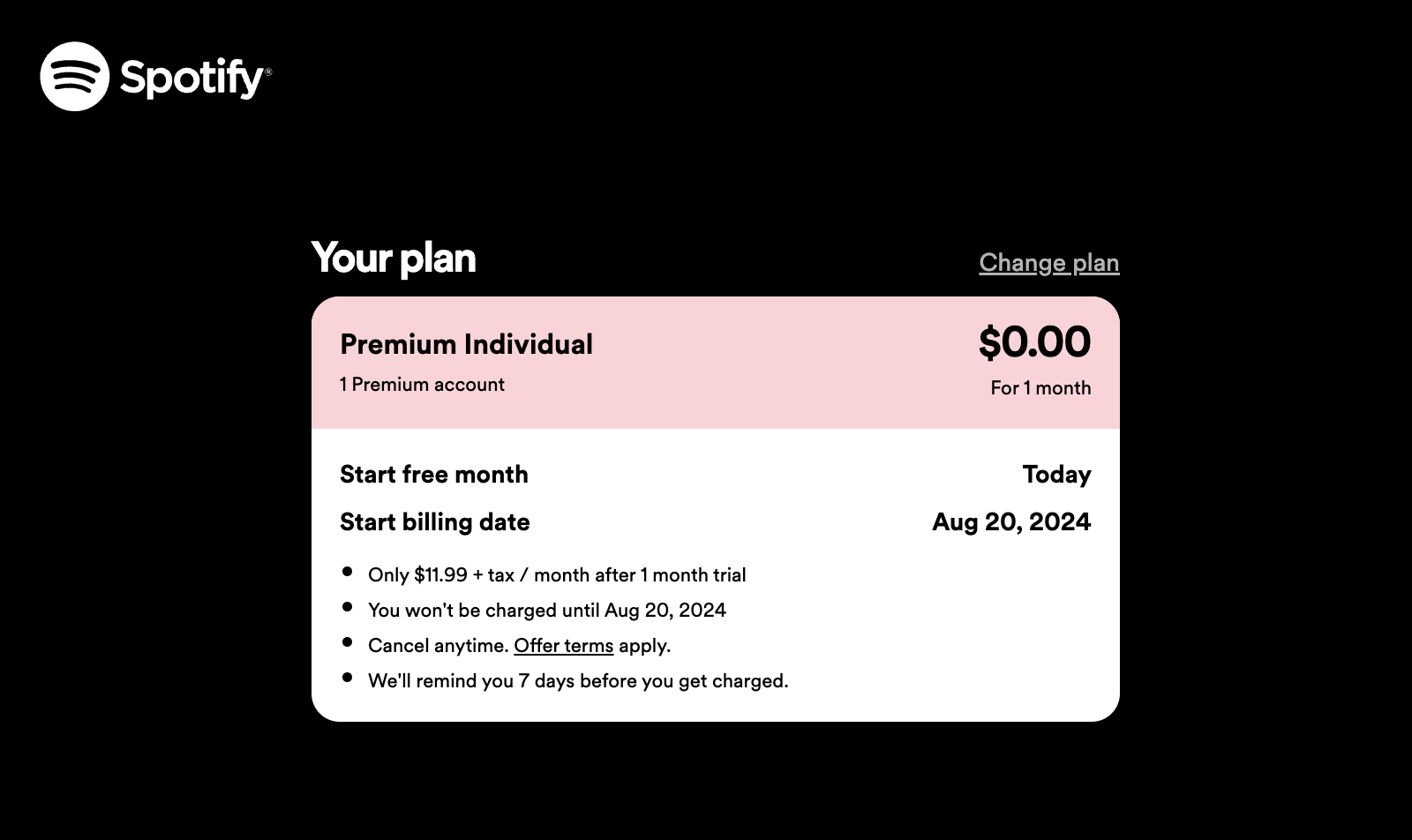

Prior to obtaining the customer’s billing information for the purposes of a subscription, a business must clearly and conspicuously disclose all “material terms,” meaning those terms likely to affect the consumer’s buying decision, whether directly related to the subscription or not.

These terms include, but aren not limited to:

That the customer will be charged unless they take action to cancel

The amount that will be billed and the frequency of recurring charges

The date by which they must cancel to avoid being billed

All information necessary to locate the cancellation mechanism

These disclosures must appear “immediately adjacent” to the means of recording the consumer’s consent to the subscription and must stand out from accompanying text or other visual elements so that they are easily noticed, readable and understandable by the average consumer.

For written offers (including online or by phone), the rule states that businesses will be deemed in compliance if consent is obtained via a checkbox, signature or other “substantially similar method,” which the consumer actively selects or signs to accept the subscription, separately from other aspects of the transaction. The consent request must be presented in a “clear, unambiguous, non-deceptive” manner and free of any information not directly related to consent of the subscription or free trial.

Additionally, the rule specifies that “[a]ll communications, regardless of media, must not contain any other information that interferes with, detracts from, contradicts, or otherwise undermines the ability of consumers to read, hear, see, or otherwise understand the disclosures.”

Subscription regulations are constantly in flux. Subscribe to stay up-to-date on the latest compliance developments, churn-prevention strategies and more.

Consent

The rule requires that a business obtain “express informed consent” to automatic renewal agreements before charging the consumer.

Businesses must:

Obtain “unambiguously affirmative consent” of the subscription separately from other aspects of the transaction

Not include information that “interferes with, detracts from, contradicts or otherwise undermines” the consumer’s ability to provide consent

Maintain a record of the consumer’s consent for at least three years, or demonstrate by a “preponderance of evidence” that its processes absolutely prevent transactions without consent

Misrepresentations

Businesses must take care not to misrepresent, expressly or by implication, any “material fact,” meaning those likely to affect the consumer’s buying decision, including:

The automatic renewal or free trial terms, including consent, any deadlines to prevent further charges, or how to cancel

Cost

“Purpose or efficacy of the underlying good or service, health or safety, or any other “material” fact

Annual notices

Like many state ARLs, the FTC’s proposed rule (2023) included an annual reminder be sent to consumers about subscription renewals, but this requirement was abandoned in the final rule.

Subscription cancellation

A key requirement of the FTC’s final negative option rule is simple cancellation, ie. “click to cancel.”

Sellers must provide a “simple mechanism” for the consumer to cancel the subscription and immediately stop recurring charges (or an initial charge after a free trial). This cancellation mechanism must be “at least as easy” as the mechanism used to consent to the subscription. At minimum, the business must allow for cancellation in the “same medium” used to sign up, effectively ending call-to-cancel policies for online businesses.

When the Minnesota Star Tribune introduced online cancellation, they did so with some trepidation. Like many businesses, they feared making cancellation easier could harm customer retention.

But with ProsperStack Retain’s powerful A/B testing features, the Star Tribune optimized their cancellation process and obtained an online save rate of 18.5%. That’s 10% higher than their call center.

“ProsperStack is one of the most important and impactful things we’ve implemented in several years,” the paper’s head of retention remarked.

See the case study.

For online cancellation, the simple cancellation mechanism must be easy to find. Interacting with a live or virtual representative is not allowed if such an interaction wasn’t required to consent to the subscription.

Presumably, a prominent cancellation button or link displayed within a customer billing portal/account/settings page is acceptable. Although the rule makes no mention of authentication, requiring a user to log in before accessing the cancellation process is also probably okay, provided this doesn’t create an unreasonable barrier.

As for multi-step cancellation flows, the proposed rule of 2023 included a provision that would have required businesses to first obtain consent before making efforts to “save” the customer (e.g. presenting a coupon or informing them of what they’ll lose when they cancel), but this limitation did not make it into the final rule. Therefore, surveys, incentives and deflections are allowed, although aggressive tactics that create barriers to cancellation are prohibited.

For cancellation via phone, businesses must make available a number to answer or record messages during normal business hours, and must promptly process all cancellations received. The call must not be “more costly” than the call used to consent to the subscription.

If consent was obtained in-person, businesses should offer (where practical) an option to cancel in-person, and must offer a simple cancellation mechanism online or via telephone.

State-based cancellation regulations

More than half of U.S. states have some form of automatic renewal law on the books; however, the FTC’s negative option rule now provides nationwide uniformity to cancellation requirements, making many of these regulations redundant. Still, a handful of jurisdictions (notably California) do have requirements that go above and beyond the federal guidelines. Learn more in our comprehensive guide:

Compliance checklist

Use this checklist to help you comply with the new click to cancel rule.

Obtain “unambiguously affirmative consent” to the negative option separately from other elements of the agreement.

Maintain a record of consent for at least three years, or demonstrate that transactions cannot happen without consent.

Avoid including any information that could interfere with the consumer’s ability to provide informed consent.

Prior to obtaining billing information, clearly and conspicuously disclose all “material terms,” including that the customer will be billed unless they take action, the amount to be billed, the frequency of charges, the deadline to cancel to avoid charges, and how to find cancellation options.

Disclosures must be “immediately adjacent” to the consent form, must stand out from other elements, and be readable and understandable by the average consumer.

Avoid misrepresenting any “material fact,” meaning those likely to affect the consumer’s buying decision.

Provide a “simple mechanism” for cancellation which is at least as easy as consent.

When a cancellation request is submitted, immediately stop all charges.

Provide a cancellation mechanism in the “same medium” as consent.

The simple cancellation method must be easy to find.

Do not require interaction with a live or virtual rep (e.g. chat bot) if no such interaction was required to consent.

Answer or record messages during normal business hours, and ensure calls are no more “costly” than consent.

Process cancellations promptly.

For consent obtained in-person, an in-person cancellation option should be provided (where practical).

In addition, provide a simple cancellation mechanism online or via telephone.

Get compliant today with ProsperStack

With the FTC’s click to cancel rule coming into effect, providing a simple cancellation process is not just a best practice—it’s the law. ProsperStack helps you stay compliant while optimizing retention.

End compliance confusion. Get one-on-one guidance from our cancellation experts. It’s free.

Trusted by brands like Nutrafol, Nestle and Hootsuite, ProsperStack Retain is churn-busting cancellation flow software with robust reporting, A/B testing and AI offer optimization. And because we integrate with your subscription billing platform, you can be up and running with just a few lines of code.

Upgrade your cancel button and start retaining more subscribers, automatically.