CA, NY Among States Cracking Down on Call to Cancel Policies – Here’s How It Affects You

Heads up, subscription-based companies. California and New York are getting tough on practices that make it difficult for consumers to cancel subscriptions.

This is part of a growing state-based and national movement to combat “deceptive” practices in subscription services. The trend went nationwide with the FTC’s announcement of a broad effort to crack down on cumbersome call-to-cancel policies.

Here’s a look at what’s happening in California, New York and nationally, plus what this means for subscription-based companies. Even if you don’t serve customers in these states, or think you’re in compliance right now, you need to remain up-to-date on what’s happening with automatic renewal laws (ARLs).

In California, required notifications and “immediate” cancellation

California has long had one of the strictest automatic renewal laws on the books and has been the setting for myriad consumer class action lawsuits triggered by its ARL, including pending actions against well-known brands such as HelloFresh, UFC and NBC. Recent settlements in the multi-million dollar range were made by Potpourri ($2.3 million), JustAnswer ($4.7 million) and the New York Times Company ($2.3 million) for alleged violations of California subscription regulations.

California has continued to raise the bar with amendments in 2017, 2021 and 2024.

The 2021 amendments require advance notice of automatic renewals and online cancellation. The regulations apply to “most” companies that sell to California consumers and took effect on July 1, 2022.

New standards include:

A required notice of impending renewal for subscriptions when the term is one year or longer or the subscription contains an expiring free trial or initial discount period longer than 31 days

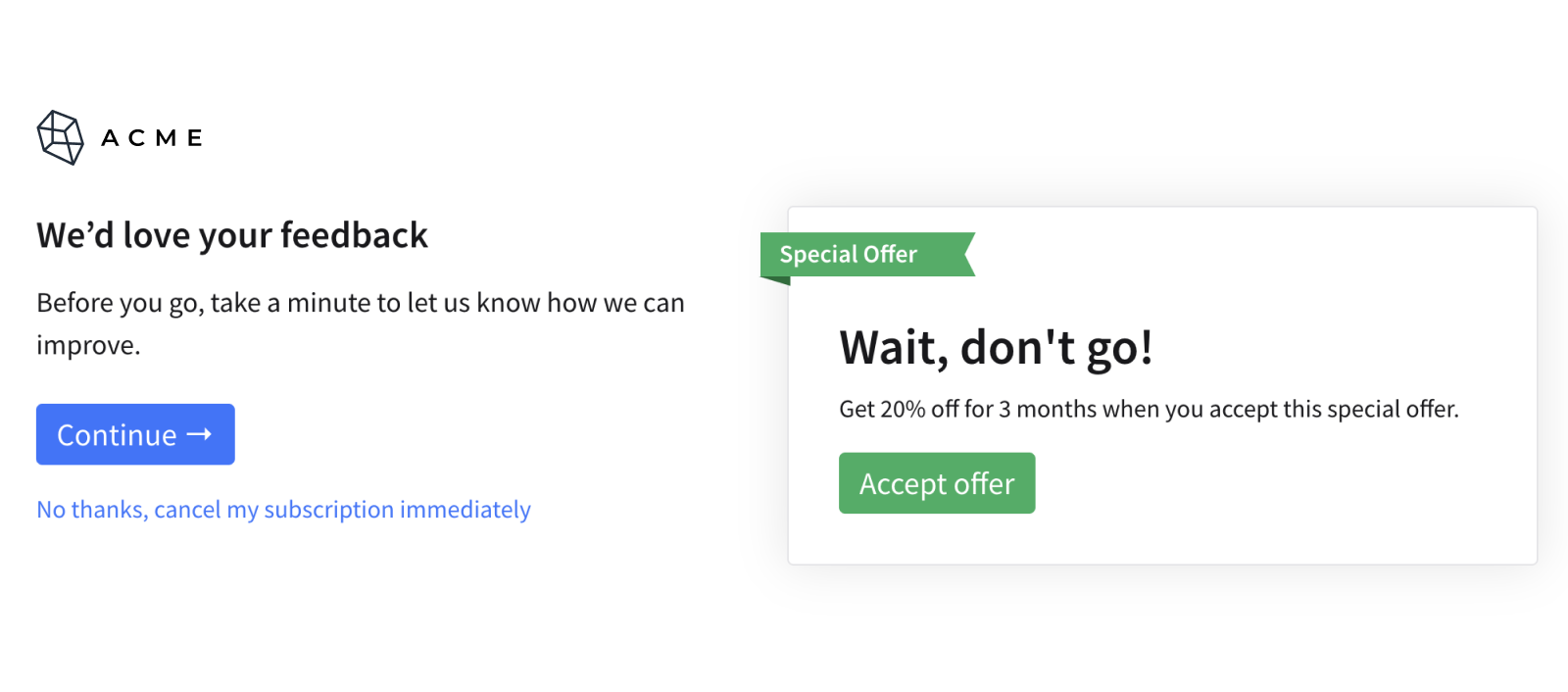

For online subscriptions, the option to cancel “immediately” online—without having to fill out a survey or jump through other hoops first. This includes either a prominent link/button in a profile/settings area or by providing customers with a pre-formatted cancellation email message.

The 2024 “click to cancel” amendment, signed into law by Governor Gavin Newsom on September 24th, requires that businesses offer a "click to cancel" option to California consumers who signed up online, among other changes. The new regulations are effective July 1, 2025.

See our California ARL compliance guide to learn more about recent changes and the full details of how these regulations affect the customer lifecycle from signup to cancellation.

When the Minnesota Star Tribune introduced online cancellation, they did so with some trepidation. Like many businesses, they feared making cancellation easier could harm customer retention.

But with ProsperStack Retain’s powerful A/B testing features, the Star Tribune optimized their cancellation process and obtained an online save rate of 18.5%. That’s 10% higher than their call center.

“ProsperStack is one of the most important and impactful things we’ve implemented in several years,” the paper’s head of retention remarked.

See the case study.

New York confronts “false and deceptive” practices

New York's automatic renewal law took effect in 2021 and follows California's lead. In a memo accompanying the New York law, sponsor Brad Hoylman writes:

New York consumers should not be lured by false and deceptive practices, nor should it be their responsibility to comb through the fine print of a sales offer to determine if they will be trapped in an automatic renewal offer. This legislation will ensure that consumers are made fully aware of the terms and conditions of any offer before they provide credit or debit card information.

New York’s law requires “affirmative consent” to offer terms, along with “clear and conspicuous” disclosures of auto-renewal terms. Like California, the New York law stipulates that companies must offer user-friendly cancellation options—including, again, the option to cancel online if they signed up online. While New York’s law doesn’t presently require immediate cancellation, it can be expected that New York—and the whole country—may be headed in that direction.

Subscription regulations are constantly in flux. Subscribe to stay up-to-date on the latest compliance developments, churn-prevention strategies and more.

What’s at stake

Online cancellation for online signups is at the center of much of the controversy surrounding automatic renewals. Call-to-cancel policies are typically designed with the assumption that making it difficult to cancel a subscription will increase retention. Of course, consumers widely dislike cumbersome cancellation procedures. Also, this type of policy has been called an “accessibility nightmare” for deaf and hard of hearing people, who make up 15% of the U.S. population.

Right now, half of U.S. states have a version of a law that addresses automatic renewal policies, with more states considering policies. The FTC’s new enforcement policy means companies may be subject to penalties even if they operate in states without laws on the books.

Penalties for violations range by state, but can include injunctions and orders for restitution. In New York, courts may also impose civil penalties for violations. The FTC has also threatened both civil penalties and legal action.

Why subscription-based companies should be vigilant, but not worried

With two of the country’s most populated states taking a strong stand—and the FTC making sweeping changes—subscription-based companies are looking for ways to attract, engage, and retain customers while adhering to the new law.

The good news for subscription-based companies: transparent, consumer-friendly business practices are great for business. While complicated cancellation policies may produce some measure of retention, they don’t generate brand advocacy, trust or loyalty.

Since the FTC elevates state-based regulations to the national level, subscription-based companies can expect that the end is here for call-to-cancel tactics. Companies that resist making a change face a tough blend of legal action and lost consumer trust.

An alternative: clear, user-friendly cancellation flows that help consumers make the right decision whenever they’re ready. Customers want to feel like they’re being catered to, not taken advantage of. It’s strongly recommended to create a cancellation flow that gathers actionable insights while maintaining compliance and making your customers feel like you’re listening to them.

Ready to see what’s possible? ProsperStack is a leader in transforming online cancellation processes to make them insightful, compelling and compliant. Schedule a demo to start reducing churn and retaining customers.