How to Calculate Churn Rate: Step-by-Step

Churn refers to the regular loss of customers from a subscription business.

"Churn rate" is the percentage of customers or revenue lost due to cancellations or downgrades over a period of time. It's a key performance indicator (KPI) you'll want to monitor on a regular basis.

How to calculate churn rate

There are more than a few ways of calculating churn rate, but two of the most common are "customer churn" and "revenue churn." As we'll see, each provides a useful way of looking at customer attrition.

Customer churn rate

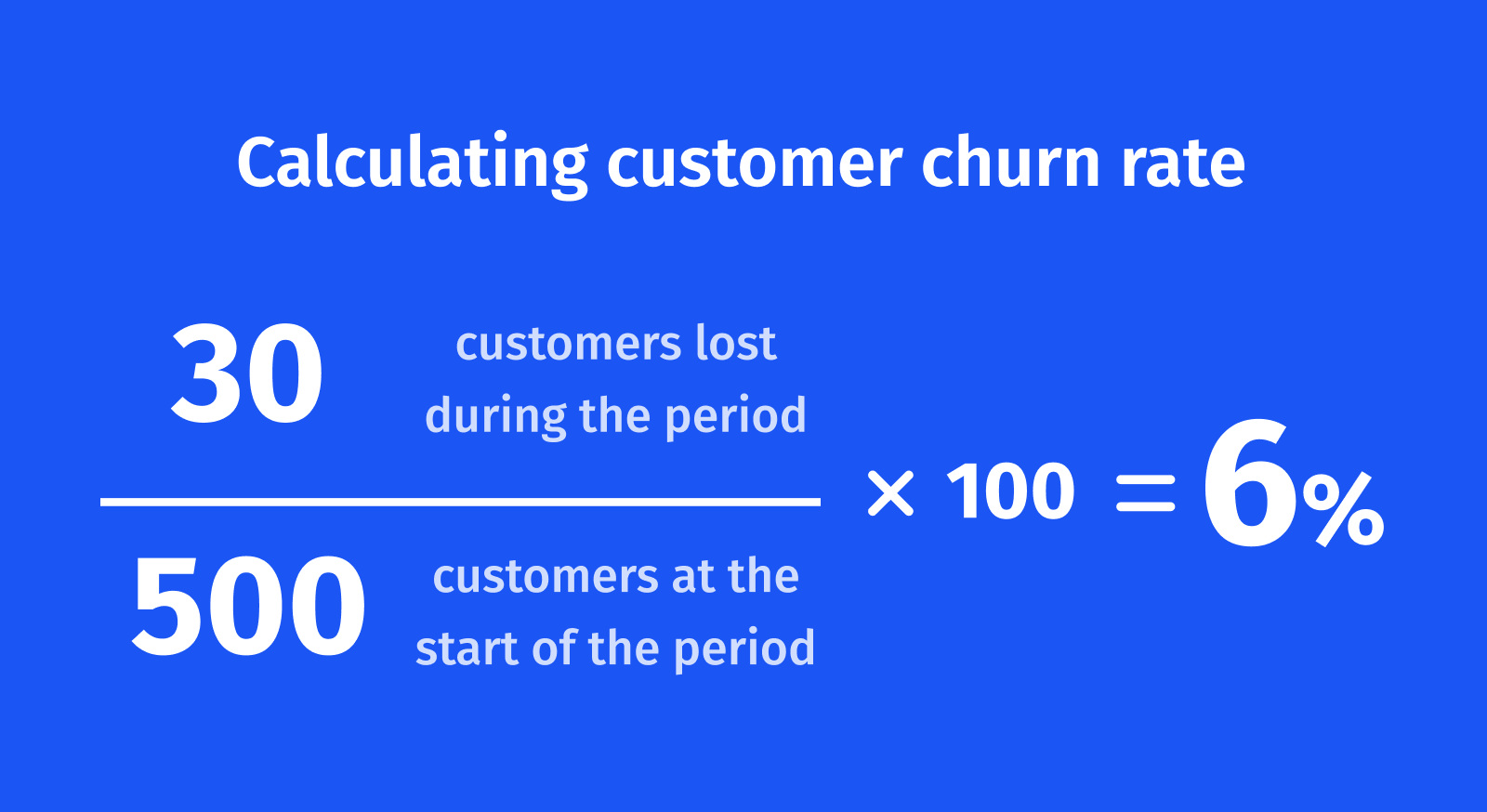

“Customer churn” is the most commonly used metric and the easiest to calculate. It’s the percentage of customers who leave your company over a period of time. To calculate it, pick your time period (monthly, quarterly, annually) and determine:

The number of customers at the start of the period

The number of customers lost during that same period

Note that customers gained during the period do not factor into churn calculations.

Then divide the second number by the first and multiply by 100 to get the customer churn rate.

As an example, let’s look at this situation:

You have 500 customers at the start of the month

30 of those customers cancel by the end of that month

The customer churn rate in this scenario is 30 / 500 = .06 X 100 = 6%.

Revenue churn rate

“Revenue churn” is the percentage of revenue reduction due to lost customers or downgrades over a period of time. Your business most likely has some customers who pay far more than others, depending on the structure of your pricing, which means revenue churn can produce different insights than straight customer churn.

Like customer churn, you’ll need to pick your time period and determine two data points:

Recurring revenue at the start of the period

Recurring revenue lost due to customer cancellation or contraction over that period of time

“Contraction” refers to the loss of revenue when a customer pays less (e.g. by going to a lower plan or removing a user) without canceling their subscription.

Note that recurring revenue gained (either from new customers or customer expansion) does not factor into revenue churn.

Then divide the second number by the first and multiply by 100 to get the revenue churn rate.

Let’s take a look at the following scenario as an example of how to calculate revenue churn:

You start a month with $100,000 in MRR

During that month, you lose customers worth $8,000 in MRR

The revenue churn in this scenario is $8,000 / $100,000 = .08 X 100 = 8%.

Which churn rate is better?

To have a clear picture of your churn you’ll need both numbers, especially in cases where you have significant differences in the payments you receive from customers and therefore individual customers are not equal from a revenue standpoint.

For example, monthly customer churn of 1% might look really good. However, if your revenue churn is 5% over the same period, you actually have a pretty big problem on your hands. While you aren’t churning many individual customers in this example, the ones who are churning are high value. Without considering revenue churn, you won't see where your problem lies.

Summing it up

At the end of the day, you cannot prevent all churn. Your goal is to keep your churn rate as low as possible, and that starts by knowing your own churn rates and tracking them over time.